Invest in companies you believe will still be needed in 5-10 years.

Investing in Bitcoin is unpredictable; everyone knows that. However, when you invest in stocks, you ought to make some sense of it. After studying the works of the great Benjamin Graham and Warren Buffet, I've reached a consensus when it comes to picking stocks to invest in for the future. While this is by no means financial advice, here are the stocks I currently invest in for the upcoming five years and why.

I'm Al, a business consultant in Zurich, Switzerland. Given my entrepreneurial zest, I've studied the lives and works of Warren Buffet, Elon Musk, Jack Ma, Jeff Bezos, Bill Gates, Larry Page, and the list goes on...

If we metaphorically say that the stock market is a demon, then the crypto market is the devil. Given the risk involved in crypto investments, investing in stocks feels trivial.

For instance, I looked at my stock portfolio a couple of days ago and noticed that it had dropped 3%. This could trigger some defensive investors. However, when I open my crypto portfolio, such a loss could occur in a 10-minute timeframe.

What one has to be aware of when picking company stocks to invest in is that these tickers are actual companies. One has to forget everything about their stock, and look into them as what they actually are, a team of people delivering a product.

The most important and only question should be:

Is that team going to be delivering this product, or a variance of it in the upcoming 5-10 years?

Then selecting stocks that you're comfortable with would make sense.

Of course, aside from that question, there are tons of other questions you should keep in mind if you're trying to be a smart investor.

Are the country and nation you're investing in excelling or not? Are they moving forward with human evolution, or do they have a mindset that will take a long time to change?

Is there any controversy around the company you're investing in? Does it have dangerous or unhealthy products?

Is the company a trending one in the previous two years? Or has it been established for quite a while?

These questions would rule out some stocks to invest in like Tesla, Meta, and Mcdonalds. However, that doesn't necessarily mean that you should not invest in these. At the end of the day, no human being on this planet would be 100% certain that a particular stock would go up or down. This is determined by a mixture of how the people are feeling, which is connected, though not 100%, to how a company is performing.

These questions are my analysis as a business consultant and market researcher who's been studying companies for quite a while and designed an investment portfolio accordingly. Let's look at the counterexample.

Example 1: Meta

Meta is investing in the metaverse, a concept that is bold, that could work, but also could fail.

Example 2: Google

Google is investing in everything related to tech. They have a diverse of acquisitions in multiple sectors like healthcare and transportation.

Looking at both examples, it sounds only logical, when looking at those two companies, that it is less risky to invest in Google than in Meta at this current time.

Does this mean that Google will outperform Meta?

No, it does not mean that. It means that the chances of harmful hits on Meta are more likely to be more than the ones on Google in the upcoming few years.

Additionally, Warren Buffet urges to invest when one has a long-term vision of a company.

"If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes."

Thereby, it's at the end of the day, based on the person's perspective. Is the world going to be dominated by the metaverse in the upcoming five years? If so, investing in Meta could return 10X. However, even if the world becomes a metaverse fused reality, Google will also return a good return. Hence, it's the safer option.

Noting that the above personal mentality represents my own as an observer of those companies and an avid reader.

Following the above methodology, here are five companies that I would put in the category of safe.

Johnson & Johnson: Given their focus on consumers and health, it's unlikely that the world would move forward without them being involved.

Google: At this moment, they're dominant in the search engine world, the video-sharing one, and deep tech. Even if google fails within time, it will be over a very long duration, rather than ten years. The way they would fail is that they would make a "Nokia" sort of mistake when there's a new player in town. Even Nokia took six years to decline in value, and their success does not compare to Google's.

Apple and Microsoft: The phone and PC industry will keep on evolving; these two players are the current top players, as their focus is a mixture of hardware and software, which is here to stay.

Disney: This company is a hundred years old. They're targetting kids. They're at this day successful. Hence, my kids will still be watching and getting involved with Disney products when they grow older, the same way I did. That's why it's quite a strong business model.

Allianz: The insurance industry is being established in our community as the vital industry after food and beverage. Humans are imperfect. We are not machines. We will have diseases and need insurance in our lives

Next Era: One of the most important companies when it comes to Solar Energy, which is proving to be the more important day after the other.

Adobe: The wide variety of their software makes it almost impossible for any designer or editor to not use their software. It's more likely that demand for their programs will increase as it's just getting more advanced in this tech designer world.

Virgin Galactic: While this is a low-performing stock at the moment of this writing, they have started a space tech revolution, and for that reason, when the industry booms, they will be there.

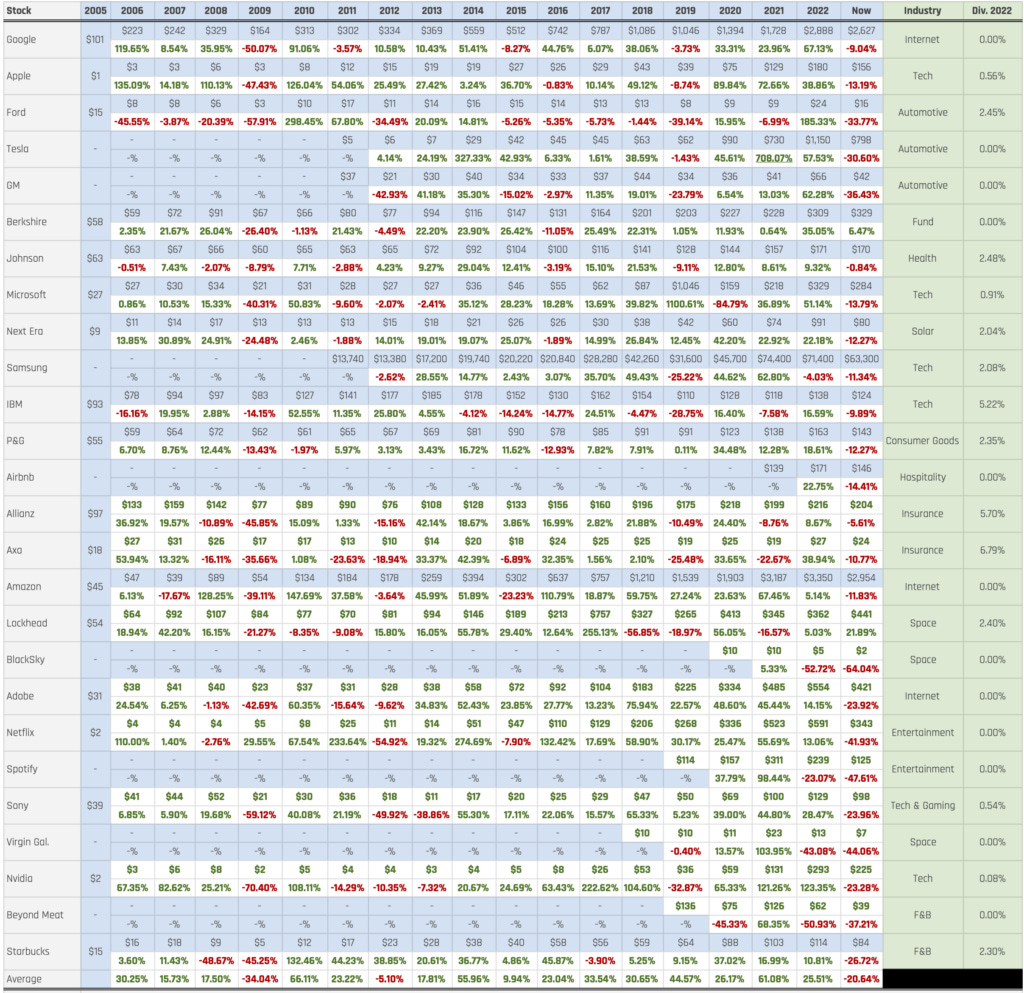

These are the most prominent companies that I've chosen to invest in after reviewing over 26 companies that have products used by me personally.

I have not reviewed more stocks as I'm unaware of their product need as much. The most logical way to begin investing is to look into your personal life and make sense of products that you believe are going to be here for the long run.

A friend of mine asked me a simple question, how does Bitcoin compare to the above?

The answer is simple. Bitcoin would outperform any stock in the above list. Then he followed up with the question, then why wouldn't I invest in Bitcoin?

Bitcoin jumped 5,690% in 2014, then 1,244% in 2018. It does not follow any performance of any company. Hence, it's like asking whether you'd like to eat apples or oranges. Investing in Bitcoin does not compare to investing in stocks. The variables in each are quite different.

The stock price has many factors that affect it. Hence, it could be predicted with a fair risk level.

Bitcoin's price (and crypto) has more factors that affect it directly and does not have any indicator when it comes to performance. Hence, it can not be predicted whatsoever.

It's very unlikely that a person investing $100k in Google would end up with $0. I can't for certain say the same thing about Bitcoin. It's an alien.

Am I advocating against Bitcoin investments?

Here's another famous quote by Warren Buffet, "Be Fearful When Others Are Greedy and Greedy When Others Are Fearful."

As a business consultant, I observe, learn, and point out. Bitcoin is one of my investments as well because I believe that it's already a proven asset that will only get bigger. Yet, I would never risk more than a small percentage of my portfolio in such an asset simply because it involves a very high-risk level.

Take home message

You earn your own money. Hence, you should invest in your own choices of stocks. If you follow the analysts at the "Big Four," you might end up with nothing. Alternatively, If you follow your friends, you might also end up with nothing.

If there's a certain equation that everyone should follow, then everyone would have fantastic returns, which is not realistic. Your own equation could return an annual of 5%, 10%, 50%. The most important variable in your investment equation is constant observation and learning. Your portfolio could change because you're going to change, and the world will as well. As long as you're not fearing change, and committed to your long-term vision, then you're on the right track.

Note: This is not financial advice, merely brainstorming and speculation based on the performance of companies.

I'm Al, a business consultant in Zurich, Switzerland. I believe in the power of delivering value to you, the reader. I'm focusing my content on being more and more on Medium and Linkedin. Hence, follow me on both channels to keep in touch and connect.